The world has recognized that protecting, restoring and managing forests sustainably is critical to keep global warming below 1.5°C and achieve net-zero emissions by mid-century. Consequently, as an increasing number of governments and companies around the world plan their own paths to net-zero, natural climate solutions (NCS) are attracting more attention than ever before. Within the broader realm of NCS, the forest sector has an important role to play in achieving the global transition to a net-zero economy by responding to the surging demand for high-quality land-based carbon sinks and by supplying the world with climate-positive forest products that support the emerging circular bioeconomy.

When it comes to climate action, institutional investors and asset managers – who manage trillions of dollars in the global economy – also have an important role to play. Like companies, investors are committing to net-zero climate targets. More than USD $57 trillion in assets and investment portfolios have already been committed to net-zero by 2050. Investors are increasingly looking for positive social and environmental impacts from their investments, in addition to economic returns. They are also searching for ways to align their portfolios with the goals of the Paris Agreement, with growing awareness of the carbon sequestration and storage capacities of forests. While the forest sector knows how to manage forests at the scale required, the challenge is creating investable opportunities that also deliver significant additional benefits for climate, biodiversity and local communities.

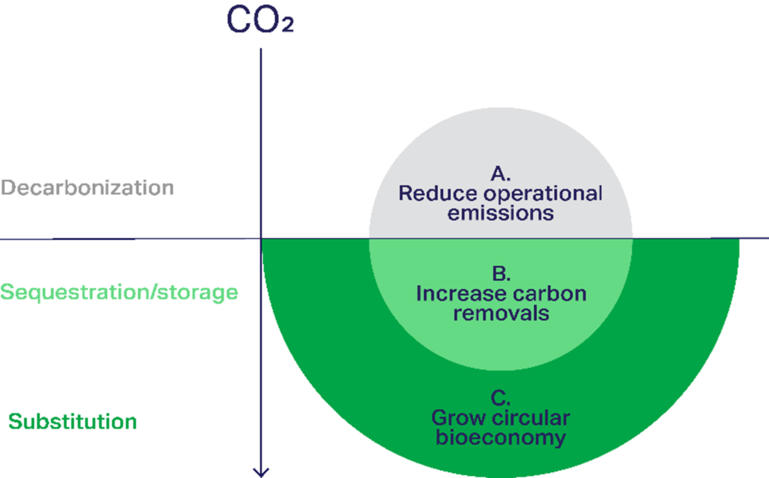

At COP26, WBCSD’s Forest Solutions Group released the Phase I report of the Forest Sector Net-Zero Roadmap that describes the role of the sector in enabling the transition to a net-zero economy through three key levers of impact: I. Reducing operational emissions; II. Increasing carbon removals in working forests and forest products; III. Growing the circular bioeconomy (see figure 1 below). While it is important to stress the urgency and priority of the first lever, we focused here on the second two levers, and discuss the role investors can play in unlocking these opportunities.

Figure 1: The forest sector’s three levers of impact

Increasing carbon removals in forests and forest products

About 30% of the world’s forests – 1.15 billion hectares – are working forests, managed primarily for the production of wood and other forest products. Sustainably managed working forests can play a critical role in mitigating climate change by removing carbon from the atmosphere and storing it in living biomass, storing carbon in harvested wood products, and providing renewable bio-materials to supply the circular bioeconomy. Critically, improved management of our existing forests and reforestation of previously deforested areas are the only large-scale, immediately deployable carbon removal technologies available today.

While there’s no question that the outright protection of standing forests is critical, it’s equally clear that improved management of working forests offers a significant opportunity to maximize the climate and biodiversity contributions of a widely held financial asset class. Timberland is a fundamental component of our economy, generating a rapidly expanding array of essential raw materials for construction, textiles, paper products, and even nanocellulose fibers for the screens of our smart phones. If we can drive climate-positive investment into working forests, we open a clear path to climate and biodiversity action at scale.

In the path to “nature-positive” economies, sustainable working forests can provide much more than just carbon sequestration – they provide clean water, critical habitat, foods and medicines, support rural livelihoods, and provide valuable aesthetic, recreational and cultural values. While the monetary value of many of these ecosystem services is not yet recognized by financial markets, the public and investors are increasingly demanding that forests be managed in ways that provide them. This is a promising new trend.

Growing the circular bioeconomy

There is an emerging opportunity to combat the climate crisis, and deliver a range of other co-benefits, by mobilizing investment for sustainably managed natural landscapes that fuel a circular bioeconomy. Through the substitution of non-renewable and fossil-based materials with sustainably produced forest products, the forest sector can play a key role in the emergence of a new economy based on the sustainable management and reuse of biological resources to produce materials, energy, and other products and services.

Mass timber is an example of one such climate-positive material. Made by layering and pressing together large wood pieces to form panels and beams, mass timber can be as rigid and durable as steel, but stronger, lighter and even more fire-resistant. Recent research shows that mass timber can reduce the embodied carbon of buildings by 50% while simultaneously storing carbon out of the atmosphere for decades or longer. Mass timber offers a pathway to decarbonize the global construction sector – responsible for perhaps 37% of global emissions – and it is a technology that is available now.

Encouraging a synergistic rather than siloed approach to forest management, material choices, policy making and investment could have profound results, unlocking the true value of forests and the circular bioeconomy in the fight against climate change. Investing in research and development to find new applications for bio-based products, and ways to maximize material efficiency (recycling, waste use and recovery), as well as collaborating across sectors and value chains to improve recovery and reuse of wood-based products, will be key to success.

How can investors drive impact at scale?

In recent years we have observed a surge of interest among investors in climate-positive forestry. While the forest sector knows how to manage forests at the scale required, the challenge is creating investable opportunities that also deliver significant additional benefits for climate, biodiversity and local communities, beyond business as usual, together with robust compliance, reporting and transparency.

To achieve this aim, we see a role for new kinds of collaborations, including with the conservation community, the development community, and civil society at large, to develop innovative approaches to drive these impacts. This is why, BTG Pactual Timberland Investment Group (TIG) has recently launched two new collaborations with The Nature Conservancy (TNC) and Conservation International.

In a first-of-its-kind agreement announced in September 2021, TIG and TNC launched an initiative to enhance climate action and conservation outcomes on more than USD $850 million of TIG’s US investment portfolio. TIG and TNC will seek to establish science-based targets with the goal of delivering on-the-ground climate and conservation outcomes at scale. TIG will seek to incorporate these targets with the objective of maintaining or enhancing financial performance.

In October 2021, TIG launched a collaboration with Conservation International surrounding a new impact-oriented reforestation investment strategy in Latin America that seeks to mobilize USD $1 billion of investment over five years. With Conservation International’s input and advice, TIG will seek to protect and restore natural forest on half the land acquired under the strategy, and establish sustainably managed commercial tree farms on the other half. As part of the strategy, TIG will also invest in the development of processing facilities that will target production of climate-positive forest products.

The urgency of the climate and biodiversity crises requires action of unprecedented pace and scale, and the forest sector has a critical role to play in aligning and collaborating with society at large. By working with investors to develop new business models and enhance the climate benefits of existing models, together with strengthening civil society and public support for the role of working forests and their products in climate action, our sector can lead the way to a net-zero future.

This post originally appeared on the WBCSD Forest Solution Group website.